Return on investment (ROI) is an essential metric that determines how profitable an investment is. It is a ratio that compares the amount of money gained or lost on an investment to the cost of that investment. ROI is expressed as a percentage, and it can be used to evaluate the success of a business, marketing campaign, or any other investment. The formula for calculating ROI is simple: ROI = (Gain from Investment – Cost of Investment) / Cost of Investment. This formula makes it easy to calculate ROI, and it is widely used in business and finance. ROI is an important tool for investors because it allows them to compare different investment opportunities and determine which one is the most profitable. For example, if an investor has two investment options, they can use ROI to compare the expected returns of each option and choose the one with the highest ROI. Additionally, ROI can be used to track the performance of an investment over time. By comparing the ROI of an investment at different points in time, investors can see whether their investment is becoming more or less profitable. It’s important to note that ROI doesn’t take into account the time value of money, which is the idea that money today is worth more than money in the future due to inflation and other factors. Therefore, ROI should be used in conjunction with other metrics, such as net present value (NPV), which takes into account the time value of money. Overall, ROI is a valuable tool for investors and businesses alike, as it provides a clear picture of the profitability of an investment.

Return on Investment or ROI is a formula that helps investors calculate the percentage of net profit or loss relative to the total cost of investment. This calculation is essential for businesses and individuals investing in stocks, rental properties, or other assets to determine whether their investments are profitable or not. To calculate ROI, one needs to subtract the total expenses from the total returns and divide the result by total expenses. This simple equation helps investors understand how much profit they have made or how much they have lost on their investment. Anticipated ROI is an estimate of the expected return on investment, which helps investors make informed decisions about investing in stocks, rental properties, or other assets that generate revenue. It is important to note that anticipated ROI is only an estimate and may not accurately reflect actual returns. Therefore, investors should always conduct thorough research before making any investment decisions. Annualized ROI is a measure of the average annual return on investment over a period of time, usually expressed as a percentage. This calculation is useful for comparing different investments with varying time periods, including rental income and dividends generated from stocks. Gross return is the total return on investment before deducting any expenses, including rental property expenses or stock trading fees. On the other hand, net return is the total return after deducting all expenses. It is crucial for investors to consider both gross and net returns while evaluating their investments in rental properties or dividend-paying stocks. Gross returns may look attractive, but after deducting all expenses, net returns may not be as profitable as expected. In conclusion, understanding ROI and its different variations is crucial for individuals investing in rental properties or dividend-paying stocks to make informed decisions about their investments and generate revenue. By calculating ROI accurately and considering gross and net returns, investors can determine whether their investments are profitable or not.

Calculating the return on investment (ROI) is an essential step in determining the profitability of your business. It helps you understand how much money you are making or losing on a particular investment. You can use an ROI calculator, which is readily available online, to simplify the calculation process. However, if you prefer doing it manually, the first method involves subtracting the initial cost from the final value. The resulting figure represents the profit or loss made from the investment. Then, divide the result by the initial value and multiply by 100 to get the ROI percentage. For instance, if your initial cost was $8,000, and the final value was $10,000, then your profit is $2,000. Dividing this by $8,000 and multiplying by 100 gives an ROI of 25%. Including all costs associated with the investment is crucial when calculating ROI. These may include escrow fees, commissions paid to brokers, taxes, and any other expenses incurred during the period of investment. Failing to factor in these costs could lead to inaccurate results and misinformed decisions regarding future investments. Additionally, it’s essential to consider the period of investment when calculating ROI. Longer periods tend to yield higher returns but also come with increased risks. Therefore, weighing these factors carefully before making any investment decisions is crucial.

Calculating the return on investment (ROI) is a crucial aspect of investing. It helps measure the potential returns and net income you can make or lose on your financial decisions.

Calculating the Return on Investment (ROI) for a residential solar installation that includes battery energy storage involves a variety of factors. You need to consider the total costs of the system, the cost of maintenance, and the savings you make on electricity bills to make informed financial decisions about investing. Additionally, it’s important to factor in the potential earnings from selling excess power back to the grid and the total returns you can expect over time. Other factors could include tax incentives or credits, changes in utility rates over time, and the lifespan of the system.

ROI (%) = [(Total Lifetime Savings + Resale Value of the System – Total System Cost) / Total System Cost] x 100. To calculate the net return, use an investment calculator to determine the annualized return. This will help you to determine the gross return on your investment.

To calculate the net return, use an investment calculator to determine the annualized return. This will help you to determine the gross return on your investment.

This simple version, however, does not account for everything that might be involved in a real-world solar installation. For a more comprehensive calculation, we could consider the following factors: investment calculator, potential returns, project, and investment alternatives. These additional keywords will give you a better idea of the overall costs and benefits of your solar project, allowing you to make informed decisions about your investment.

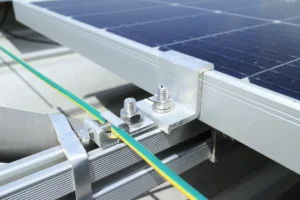

Initial System Cost (ISC): This includes the cost of the solar panels, battery storage, inverter, wiring, and installation. To help you with your investing project, you can use an investment calculator to explore investment alternatives.

Annual Energy Savings (AES): This is the money you save on electricity bills due to your solar installation. You can use an investment calculator to determine the potential return on your investment, and compare it with other investing alternatives. Your solar installation can also be considered as one of your assets, which can be a wise investing decision.

Annual Maintenance Cost (AMC): Solar systems, as assets in a project, require some level of maintenance, and this cost should be factored in when investing. This could include things like cleaning and repairs, which can be calculated using an investment calculator.

Incentives (I): This includes any tax credits, grants, or rebates that reduce the system cost for investors who are investing in a project. You can use an investment calculator to determine the benefits of these incentives for your project.

Feed-in Tariff Earnings (FITE): If your system produces more electricity than you use, you might be able to sell the surplus back to the grid. The earnings from this, along with your investment calculator, can be added to your return on investing in cash assets.

Depreciation Value (DV): The value of the system decreases over time, similar to a car or other large purchase. This should be factored in as a cost when using an investment calculator to determine the potential return on investing in assets like this project.

Lifespan of the System (LS): Solar systems don’t last forever. The lifespan is typically around 25-30 years, although it can be longer or shorter depending on the specific equipment and maintenance. When investing in a solar project for your home, it’s important to consider the net return over the lifespan of the system.

ROI (%) = {[(AES * LS + FITE * LS + I – (ISC + AMC * LS + DV)) / (ISC + AMC * LS)]} x 100 for your project investment or home.

This equation calculates the net savings over the lifetime of the home solar project system (income from energy savings and feed-in tariff earnings, plus incentives, minus the initial system cost, maintenance, and depreciation), then divides by the total cost of the system (including maintenance), and finally multiplies by 100 to get a percentage.

Keep in mind this formula is quite generalized and may not cover all specific circumstances, especially when it comes to a project or home. It also simplifies the calculation by not taking into account the time value of money. A full financial analysis might use a method like Net Present Value or Internal Rate of Return to give a more accurate picture.

When calculating the return on investment (ROI) for a project, it is important to take into account all costs associated with the investment. This includes not only the initial investment cost for a home project, but also any transaction costs and ongoing maintenance costs. By accurately analyzing all of these costs, you can get a more accurate picture of the true ROI of your home project investment. For example, if you only consider the initial cost of a home project investment without factoring in ongoing maintenance costs, your ROI calculation will be inaccurate. This could lead to poor decision-making and potentially negative financial outcomes. Therefore, it is crucial to carefully consider all costs when calculating ROI for your home project to ensure that you clearly understand the potential returns on your investment.

Return on investment, or ROI, is an important metric that businesses use to evaluate the profitability of their investments. A good ROI indicates that the investment has generated positive returns and is contributing to the overall growth of the business. It is calculated by dividing the net profit by the cost of the investment, expressed as a percentage. This percentage can then be used to inform financial decisions and business strategy. By understanding potential returns and investment costs, businesses can leverage their resources and make informed decisions about investing in new ventures or expanding their investment portfolio. However, it is important to note that ROI can be influenced by various factors such as marketing efforts, risk tolerance, and net profits. For example, a business that invests heavily in marketing may see a higher ROI due to increased customer acquisition and sales. On the other hand, a business with a low-risk tolerance may see a lower ROI due to conservative investment strategies. Therefore, it is crucial for businesses to carefully consider these variables when making financial decisions. To maximize their chances of achieving a positive ROI and driving long-term growth, businesses should maximize revenue and minimize costs. This can be achieved through various strategies such as increasing sales, reducing expenses, and improving operational efficiency. By doing so, businesses can increase their profitability and create a sustainable business model that can withstand market fluctuations and economic downturns.

Calculating the return on investment (ROI) is a crucial step in determining the success of an investment project. However, relying solely on negative ROI can be misleading. It is important to consider all costs and benefits associated with the investment project to understand its performance. For example, if a home investment has a negative ROI but it leads to increased brand awareness or customer loyalty, those benefits should also be considered. The time frame used for calculating ROI can significantly impact its accuracy. A short-term home investment may have a high ROI initially, but it may not perform as well over a longer period. Therefore, it is essential to use a realistic time frame when calculating ROI for a home investment project. Lastly, relying on one ROI calculation may not provide a complete picture of home investment performance. Monitoring and evaluating home investments regularly is important to ensure they are meeting their goals and objectives. Investors can make informed decisions about their home investment portfolios by considering all costs and benefits, using a realistic time frame, and monitoring home investments regularly.

When it comes to calculating the return on investment, there are various investment alternatives that one can consider. It’s important to diversify your portfolio and include additional assets to measure investment performance accurately. One way to do this is by focusing on the actual net gain from an investment. This means looking at the total amount of money gained after taking into account any expenses or fees associated with the investment. Additionally, using other metrics such as payback period or internal rate of return can also provide valuable insights into the performance of an investment. It’s also essential to consider other factors, such as risk, liquidity, and tax implications, before making investment decisions. By taking all of these factors into account, you can make informed decisions about your investments and maximize your returns.

Calculating the return on investment (ROI) is an essential aspect of measuring the success of any business investment. It is a performance metric that helps businesses determine the effectiveness of their investments and assess their financial health. ROI is an important tool for identifying profitable ventures and allocating resources accordingly. By analyzing the ROI, businesses can evaluate the benefits of investing in different projects or initiatives and make informed decisions about where to allocate their resources. The actual ROI is calculated by dividing the net profit generated by an investment by the total cost of the investment. The net profit is the revenue earned from the investment minus all associated costs, such as labor, materials, and overhead expenses. The total cost includes all expenses incurred in making the investment, including initial capital expenditures and ongoing operational costs. Understanding actual ROI allows businesses to make informed decisions and adjust strategies for maximum returns. By accurately tracking and analyzing ROI, businesses can identify areas for improvement and optimize their investments for better returns. For example, if a business invests in a marketing campaign that generates a low ROI, it can adjust its strategy to focus on more profitable marketing channels or improve its messaging to increase conversions. In conclusion, calculating actual ROI is a critical tool for businesses looking to measure the success of their investments. It provides valuable insights into the profitability of different ventures and helps businesses allocate resources effectively. By understanding actual ROI, businesses can make informed decisions and adjust their strategies to maximize returns and achieve long-term success.

Keep in mind this formula is quite generalized and may not cover all specific circumstances. It also simplifies the calculation by not taking into account the time value of money. A full financial analysis might use a method like Net Present Value or Internal Rate of Return to give a more accurate picture.

Calculating the returns on investment of a residential solar system project is an important step in determining whether it is worth the initial cost. To begin with, the total savings can be calculated by subtracting the annual electricity bills after installing the solar system from the annual electricity bills before installation. This difference represents the amount of money saved each year on the project. Next, the initial cost includes the cost of purchasing and installing the solar panels and any additional costs such as permits, inspections, and maintenance for the project. Once you have both the total savings and the initial cost for the project, divide the total savings by the initial cost to get a decimal value. Multiply this decimal value by 100 to convert it into a percentage representing the project’s return on investment. It is important to note that the return on investment for the project will vary depending on location, energy usage, and available incentives. Additionally, it is important to consider the long-term benefits of a residential solar system project, including increased home value and reduced carbon footprint.

Investing in residential solar systems is a profitable project that offers numerous financial and environmental benefits, and a key measure of these benefits is the return on investment (ROI). With the decreasing cost of solar panel installation and the increase in efficiency, homeowners are seeing a higher ROI, making solar systems an increasingly attractive investment project. Firstly, solar systems significantly reduce or even eliminate monthly electricity bills, saving homeowners substantial money over time. Additionally, many regions offer solar tax credits and incentives, further decreasing the initial investment cost of the project. Secondly, solar panels add considerable value to the home, thereby increasing its market value as part of the project. Furthermore, the adoption of solar energy contributes to reducing our carbon footprint by harnessing renewable energy, making it a sustainable investment project that offers both economic and environmental dividends. Hence, the ROI for residential solar systems is beneficial from multiple perspectives as part of this project.

Calculating the return on investment for residential solar systems is an important aspect of determining whether installing solar panels is a smart financial decision for your project. The ROI ratio is calculated by dividing the net profit by the cost of the investment. In the case of residential solar systems, the net profit is the amount of money saved on electricity bills over the system’s lifetime minus the initial installation cost of your project. The initial cost includes not only the solar panels themselves but any additional equipment and labor costs associated with installing the system for your project. It’s important to note that a good ROI ratio for residential solar systems is typically around 10-15% for your project. This means that for every dollar spent on installing a solar system, the homeowner can expect to see a return of 10-15 cents per year in energy savings for your project. However, it’s also important to consider other factors that can affect the ROI ratio, such as tax incentives and rebates offered by federal and state governments for your project. These incentives can significantly reduce the initial cost of installation, making solar power a more attractive option for homeowners in your project. Another factor to consider when calculating ROI is the lifespan of the solar panels for your project. Most solar panels come with a warranty of 25 years or more warranty, but their actual lifespan can vary depending on weather conditions and maintenance for your project. It’s important to factor in potential replacement costs when calculating ROI and any potential increases in electricity rates over time for your project. Overall, calculating ROI for residential solar systems requires careful consideration of several factors for your project. While a good ROI ratio is typically around 10-15%, it’s important to consider other factors, such as tax incentives, panel lifespan, and potential replacement costs, in order to make an informed decision about whether solar power is a smart financial choice for your home project.

What Is The Expected Lifespan Of Batteries In A Residential Solar System? Overview of Residential Solar Systems Residential solar systems have gained popularity in recent

Difference Between String And Microinverters In A Solar Panel System? The world is gradually shifting towards renewable energy sources, with solar panel systems being one

What Is The Average Roi For A Residential Solar Panel System? As the world becomes increasingly aware of the need to transition to sustainable energy

What Are The Most Common Mistakes When Getting A Residential Solar? The most Common Mistakes When Getting A Residential Solar System Solar energy has become

How To Know If My Solar Compatible With Electrical Setup? Installing a solar panel system is an excellent way to reduce reliance on traditional electricity

How Do I Ensure That My Solar Panel System Is Properly Grounded? Properly grounding a solar panel system is crucial to ensure safety, optimize performance,